Key points

- 1 in 3 American workers who have a high deductible health plan which offers a lower monthly premium in exchange for a higher deductible. Usually this is combined with a Health Savings Account (HSA) or a Health Reimbursement Arrangement (HRA) to help save for future medical expenses while providing flexibility and discretion over how you use your health care.

- Simply asking about the self-pay rate and comparing that rate to your insurance negotiated rate could possibly save you money, and certainly make for a less stressful overall experience.

Melissa's story

Melissa always considered herself to be savvy when it came to planning for medical bills and monitoring healthcare expenses. Growing up, money was often tight in her family and had to be carefully spent. When Melissa formed a family of her own, she carried those values and habits with her.

She’s had no lack of practice in budgeting over the last two years. In April of 2021, Melissa gave birth to her second child. She and her husband are now raising two children under age two, and have lots to keep track of.

Melissa knew that giving birth in a hospital would come with a steep price tag. Of the roughly $40,000 total bill, Melissa and her husband would be responsible for about $6,000 under their insurance plan — a cost that they had planned for.

Melissa is among the roughly 1 in 3 American workers who have a high deductible health plan. Although it was early in the year, her hospital delivery meant that Melissa’s family had already reached their deductible — meaning their insurance would kick in to fully cover additional in-network care.

So when it became clear that Melissa needed knee surgery a few months later, it felt easier to say yes. She could move forward with less fear or stress about exorbitant costs, and instead focus on taking care of herself.

After the knee operation, Melissa wasn’t expecting to see all the bills that arrived in the mail – one, two, three, four, five, six — for the single procedure. “The most irritating piece of this entire experience was the number of medical bills we received in total,” said Melissa. Beyond the surgery itself, she was charged separately for services from the anesthesiologist and the equipment she needed for recovery, like crutches.

“I really felt the expression, ‘death by a thousand cuts,’” Melissa said. “Anybody who’s ever had a medical procedure done can relate,” she said.

And even with all of her careful budgeting, Melissa hadn’t realized that she hadn’t yet hit her plan’s “out-of-pocket maximum” of $7,000 (this means the most that a person has to pay for covered services in a plan year, according to Healthcare.gov.) It turns out that only after Melissa spent $7,000 on deductibles, co-payments or co-insurance for in-network care would her insurance plan actually pay 100 percent of her costs — even though she’d hit her deductible.

To pay the co-insurance for the procedure, Melissa ended up shelling out more than $1,000. More than anything, she was frustrated — and fed up — with being caught by surprise when she’d done all that she could to avoid that exact scenario.

This year, Melissa has resolved to approach healthcare for her family in a different way. For each of her family’s doctor’s visits, she asks about the self-pay price to understand whether cash would be more cost-effective over using insurance.

Like many, Melissa wants to understand the total cost upfront so she can have control over her decisions — and make conscious choices about how and what to pay for. More and more, Melissa is using self-pay in situations when she might have assumed that insurance was beneficial in the past.

“To me, there’s so much value in having clarity on the front end to avoid the stress of surprise medical bills that will inevitably arrive months later,” Melissa said. Her quest for clear information is also aided by recent laws that require insurance companies and hospitals to make prices simpler and more transparent for patients.

And in asking these questions, she’s reclaiming power in a convoluted healthcare system that’s designed to favor big institutions — like insurance companies and hospital systems — over individual people.

“Hopefully this year doesn’t bring any additional surgeries or procedures,” she said. “But if that is the case, I will absolutely be asking about self-pay options and really advocating for more clarity around the total expense.”

Actual user story. All pricing details are reported by the individual. Names may have been changed to protect anonymity. If you’d like to share your experience dealing with a surprise medical bill, write to us at clearprices@solv.com to tell us your story.

Five tips for choosing to self-pay for healthcare

Melissa's not alone in her frustration and confusion around our healthcare system, of course. When considering self-pay, there is a lot to keep track of. Here's a quick break down the self-pay process one step at a time.

- Assess the situation. What kind of medical care do you need? Is this a routine or big-ticket item? What month of the year is it, and how close are you to hitting your deductible?

- Do your research and shop around to compare prices. First, you should try to figure out how much the procedure costs in-network. You can use an insurer’s online tools or call the company (keeping in mind that final costs fluctuate, and may not exactly match the quote). Costs often vary widely by provider and region of the country, so this step is extra important.

- Directly ask providers what their cash prices are. Some providers may not make it easy to find estimated prices, so be persistent and remember that you’re entitled to this information: as of 2021, hospitals are required to provide patients with the cash price information during a visit even if the patient has insurance.

- If the insurer’s cost is higher, ask providers for a cash discount. You may be surprised at how many providers will do this when they ask. That’s key: patients often have to pose the question, according to KTVB. However, some providers committed to transparency make this information easily accessible upfront, or advertise discounts widely. Other hospitals feature price estimate calculators on their websites.

- If you decide to go with cash prices out of network, compare local competitors. Once patients aren’t limited to providers in-network, they can choose between a wider range of doctors.

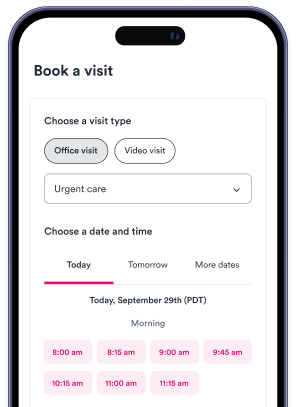

Learn more about Solv’s commitment to cracking open the mystery of healthcare pricing through our Solv ClearPrice Pledge. Try our Solv ClearPrice calculator to find the cost of care for services in your zip code, or take the quiz to find out if you should be asking for the ClearPrice of care in advance of care.

FAQs

Is paying with health insurance always cheaper?

Not always. Depending on your insurance plan, your provider, and what service you require, the self-pay rate may actually be less expensive than the insurance negotiated rate. And if you have a high deductible health plan, it may make sense more often to go the self-pay route, particularly later in your plan year.

Why is the self-pay rate sometimes less expensive?

Health insurance companies don't have much incentive to negotiate down the rates they set with providers. They eventually pass the costs onto patients (their policyholders) and make a profit off them anyway. Additionally, providers generally spend a lot of time and money working through insurance companies and their layers of bureaucracy. It's cheaper for them to just collect payment directly from the patient at the time of service, a savings they sometimes apply as a significant discount for those willing to self-pay.

When should I pay the self-pay rate for healthcare services?

The short answer: it depends. What you really should do is ask about the cost of care, both when applying your health insurance (if you have it) and if electing to self-pay. Gather the information prior to receiving care (whenever possible) and make an educated decision for yourself.

What are self-pay rates?

Self-pay prices (also commonly known as “cash” pay prices) refer to the prices that you would pay for services if you didn’t have insurance or if you didn’t want your insurance to be billed.