Key points

- Price transparency in healthcare requires clear, free-of-charge information about the cost of procedures, tests, and related expenses.

- New federal laws are being implemented from 2021 to 2024 to improve cost transparency in healthcare.

- Despite the laws, as of July 2021, only 6% of U.S. hospitals made their prices publicly available.

- The new regulations aim to reduce surprise medical bills and enable consumers to compare costs and make informed decisions.

No one likes receiving a surprise medical bill, especially when the cost wasn’t clear at the time you needed care. Unmanageable medical fees have created a national financial crisis:

- Nearly one in five households in the U.S. have medical debt, according to the U.S. Census Bureau.

- In 2020, collection agencies held over $140 billion in unpaid medical debt, according to a study published in the Journal of the American Medical Association.

- High health-related charges are the leading reason why unpaid bills are sent to collections, according to U.S. Consumer Financial Protection Bureau.

- Medical debt leads to over half the bankruptcies filed in the United States every year, according to a survey published in the American Journal of Public Health.

New federal laws requiring cost transparency in healthcare began going into effect in January 2021, with additional measures scheduled to take effect through 2024. These new policies, which have been in the works since the Affordable Care Act, are designed to make it easier for Americans to make informed decisions about their care and expenses. Here’s what you can expect.

What is price transparency in healthcare?

Price transparency requires hospitals and insurers to provide clear, easy-to-find information so consumers understand how much procedures, tests, supplies, and related expenses will cost before receiving care. Cost information has to be provided free of charge to the public, and it has to reflect real-time rates.

The regulations for healthcare transparency were created by:

- provisions of the Affordable Care Act, which requires hospitals to make costs public;

- the Transparency in Coverage Act, which introduces new rules for health insurance plans;

- and the No Surprises Act, which introduces new rules for billing.

Together, they are intended to help Americans know how much they will pay for services and enable them to compare costs and shop around. Ultimately, advocates hope cost transparency in healthcare will empower people to demand more affordable care.

What are the new healthcare rules that relate to price transparency?

Several new rules will help make it easier to understand what you pay for health care services. The first, the Hospital Price Transparency Rule, requires hospitals to make it easy for patients to see what different services cost. Here are the other rules and a timeline of how they will be implemented:

2021

The Hospital Price Transparency Rule goes into effect January 1, requiring hospital prices to be made public.

2022

The Health Plan Price Transparency Rule goes into effect July 1. Phase 1 requires prices to be made public, including in-network rates, out-of-network allowed amounts, and prescription drug prices.

The No Surprises Act interim final rule goes into effect in 2022 on a rolling basis. It bans:

- surprise billing for emergency services

- high out-of-network cost-sharing for emergency and non-emergency services

- out-of-network charges for ancillary care at in-network facilities

- out-of-network charges without advance notice; notice must be given in plain language and patient consent is required

2023

Phase 2 of the Health Plan Price Transparency Rule requires plans to offer shopping or price comparison platforms for health care services, with prices for the 500 most common services and items, effective January 1.

2024

Phase 3 of the Health Plan Price Transparency Rule requires plans to expand price comparison platforms for health care services with the prices for all services and items, effective January 1.

According to the Hospital Price Transparency Rule, hospital prices for services that patients can schedule in advance should be available to the public in several ways, including machine-readable files (such as .csv files) and online in a user-friendly format. All the service descriptions should use plain language, be clear, and be easy to find. And, services that are usually provided together—ancillary services—should be grouped to give patients a better idea of their out-of-pocket costs.

For example, suppose you plan to have surgery. Federal law requires the hospital to show prices for the procedure along with the anesthesia, imaging, labs, supplies, facility fees, and fees for hospital-employed professionals together. The goal is to help you avoid a surprise bill for a service you might not otherwise have known was a part of having the procedure, and to help you clearly see what’s being billed at in-network and out-of-network rates.

Hospitals that don’t comply with healthcare transparency regulations face daily fines.

What if my hospital doesn’t have a list of their charges available, even though the Hospital Price Transparency Rule is in effect?

Even though the federal law requires hospitals to provide easy access to their prices as of January 1, 2021, compliance has been slow. As of July 2021, only six percent of U.S. hospitals made their prices publicly available, according to a report by Patient Rights Advocate, a non-profit advocacy organization. By September 2021, the U.S. Centers for Medicare and Medicaid Sevices (CMS) had issued over 256 warnings to hospitals, according to Bloomberg Law.

The Hospital Price Transparency rule initially set fines of $300 per day for failing to provide pricing information, and many hospitals simply decided to pay the fine. So CMS proposed more significant penalties (which, as of November 2021, have yet to be put in place):

- Hospitals with 30 beds or fewer would pay $300 a day for failing to comply;

- Hospitals with more than 30 beds pay $10 per bed per day, up to a daily maximum of $5,500;

- The proposed fine hike sets the minimum penalty for a year of failing to comply at $109,500 per hospital and the maximum at $2,007,500.

Regardless of the number of hospitals that aren’t yet making prices public, you are still entitled to price transparency. Ask. Only one in ten Americans know they should be able to see hospital prices before receiving care, according to a Kaiser Family Foundation Health Tracking Poll. If you can’t find your hospital’s rates online and they can’t provide that information when you ask, you can file a complaint at cms.gov.

What if I have health insurance? Should I care about this?

Suppose you get care from a provider or facility that you don’t realize is not in your health insurance plan’s network. Or maybe you have a high-deductible plan with coverage terms that aren’t clear. You’ll likely get a surprise bill from your provider holding you responsible for paying what your health insurance plan didn’t cover at out-of-network rates. Often, according to an investigative report from the Wall Street Journal, the amount the patient is responsible for is far above the negotiated in-network rates.

You can hope to see fewer surprise bills in the next few years. Other provisions of the healthcare transparency law will make it easier for you to know what your insurance will cover and what you’ll have to pay. In January 2022, insurance plans must provide publicly available machine-readable lists (again, such as .csv files). These lists must include their negotiated in-network rates, out-of-network allowed amounts (which is the cost that your insurance company has determined as reasonable for any service), and prescription drug prices.

In January 2023, health insurance plans have to go a step further and provide online shopping platforms that allow consumers to look up prices for 500 of the most popular medical services and procedures. You’ll be able to see the negotiated in-network rates between providers and your health insurance plan and a personalized estimate of your out-of-pocket cost. In 2024, the law requires healthcare shopping platforms to include prices for remaining services, prescription drugs, medical equipment, and more. With these tools, advocates believe you’ll have information to make better decisions about your health care and managing your finances.

What if I don’t have health insurance? What should I know or ask?

According to the Wall Street Journal report, hospitals are charging uninsured patients more than insured patients. Ask for their prices before you get service. In addition to their costs for services, hospitals have to show the discounted rates they are willing to accept from patients paying cash.

A significant concern for uninsured people is the cost of emergency services. Provisions of the No Surprises Act, which goes into effect in 2022, aim to help limit what you pay for emergency care. Providers must perform those services to you at in-network rates, no matter where you receive care, and without prior authorization. The law also bans out-of-network charges without giving you advance notice and getting your consent.

If or when you decide to get health insurance, healthcare transparency will make it easier to shop for plans. You’ll likely be able to see more details about what insurers pay for different services.

How do I find out the cost of care from my provider?

Hospitals aren’t required to show you rates for health professionals they don’t employ. But you still have some ways to learn more about what health care will cost before you receive it, whether or not you have insurance.

If you’re insured, start with calling your insurance company or looking online to find what they cover and how much they pay for the services you need. Then ask the provider what they bill for a service. You can use those two amounts to get an estimate of what your out-of-pocket costs will be. Here’s an example:

- Your provider bills $500 for a service

- Your insurance company pays $300 or 60%

- The difference (your out-of-pocket cost) is $200

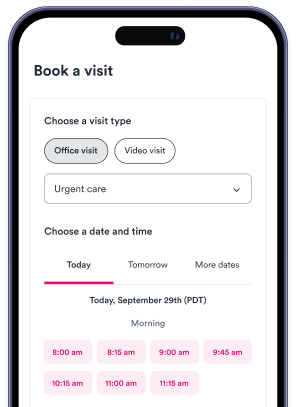

Finally, shop around. Solv is committed to making it easy for you to see the self-pay cost of common services before you book so you can find providers who fit your budget before you make an appointment.

FAQs

What is price transparency in healthcare?

It is the requirement for hospitals and insurers to provide clear, free information about the cost of medical procedures, tests, and related expenses.

What are the new federal laws regarding price transparency in healthcare?

The new laws, being implemented from 2021 to 2024, require hospitals and insurers to make their prices public and provide tools for consumers to compare costs and make informed decisions.

Are all hospitals complying with the new price transparency laws?

No, as of July 2021, only 6% of U.S. hospitals had made their prices publicly available.

What is the purpose of these new regulations?

The regulations aim to reduce surprise medical bills, allow consumers to compare costs, and make informed decisions about their healthcare.

What can I do if my hospital doesn't provide price information?

If a hospital doesn't provide price information, you can file a complaint at cms.gov.

How can I find out the cost of care from my provider?

You can find out the cost of care from your provider by calling your insurance company or looking online to find what they cover and how much they pay for the services you need. Then, ask the provider what they bill for a service. The difference between these two amounts is your out-of-pocket cost.

What if I don’t have health insurance? What should I know or ask?

If you don't have health insurance, you should ask for the prices before you get service. Hospitals have to show their costs for services and the discounted rates they are willing to accept from patients paying cash. You should also be aware of the cost of emergency services, which should be provided at in-network rates, no matter where you receive care.

What is the goal of healthcare price transparency?

The goal of healthcare price transparency is to help Americans know how much they will pay for services and enable them to compare costs and shop around. Advocates hope cost transparency in healthcare will empower people to demand more affordable care.